The average thread price fell below 5,000CNY, and steel prices continued to be weak.

-China Steel News

- On 22th, June, the domestic steel market fell across the board, and the ex-factory price of Tangshanpu’s billet fell by 50 to 4,800 CNY/TON.

- Weak steel demand in the off-season, coupled with the impact of the sharp drop in the black futures market at the beginning of the week, increased market pessimism, and merchants generally cut prices for shipments, mainly destocking.

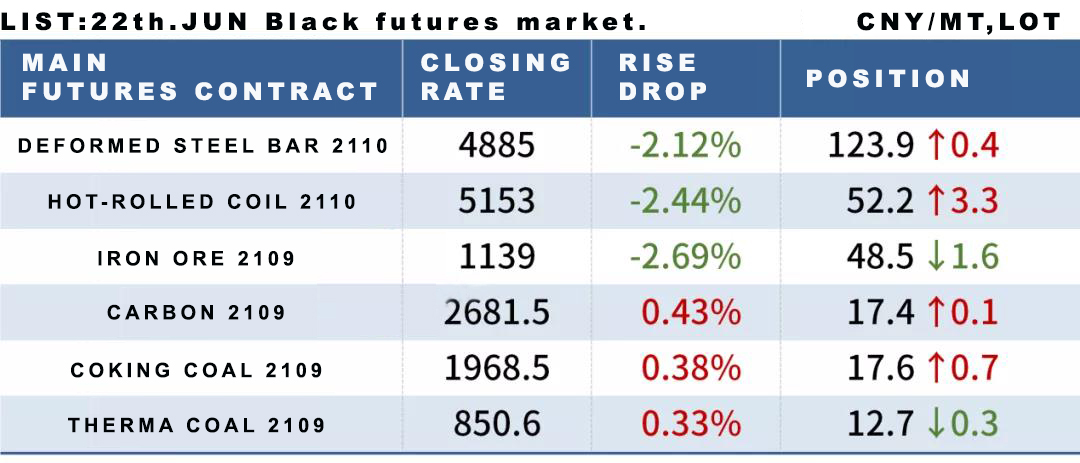

- On the 22nd, the main force of snail futures opened low and fluctuated. The closing price of 4885 fell 2.12%. DIF and DEA tended to be parallel. The three-line RSI indicator was at 34-46, running between the middle and lower rails of the Bollinger Band.

Raw material spot market:

- Imported ore: On June 22, the imported iron ore market oscillated, the overall market activity was low, and transactions were average throughout the day. As of press time, only some market transactions have been investigated: Qingdao Port PB powder transaction is 1455 CNY/Mt, and Rizhao Port PB powder transaction is 1460 CNY/Mt.

- Coke Carbon: On 22th. June, the coke market was operating steadily and strongly, and the market sentiment was bullish. After many coke companies started to decline, they rose by 120 CNY/Mt in the first round.

Due to the impact of its own coking production restrictions, individual steel mills in Shandong have clearly expressed their acceptance of this round of price increases, and mainstream steel mills have stable inventories. They have not responded to this round of increases, and some of the first round of increases have landed.

Shanxi coking enterprises have higher profits per ton of coke, higher production enthusiasm, and lower pressure on inventory in the factory.

On the demand side, due to the tightening expectations on the supply side, some steel mills have increased their purchasing enthusiasm, and most purchasing needs have remained relatively stable. On the whole, the coke market is relatively strong and may usher in another rise in the short term.

- Scrap steel: On 22th.June, the scrap market price weakened. The average scrap price in 45 major markets across the country was 3,216 CNY/Mt, which was 17 CNY/Mt lower than the price of the previous trading day.

On the 22nd, the thread and hot coil futures continued to close down, and the finished product spot fell mainly. The market continued to be weak, which continued to drag the scrap market trend;

However, considering that the current scrap market resources are tight, it is expected that the short-term scrap price will continue to run weakly but the decline will not be too great.

Steel market forecast:

- On the supply side: It is estimated that the average daily output of crude steel in the country in mid-June is 3.0764 million tons, a decrease of 0.19% from the previous ten days.

- In terms of demand: surveying 237 distributors, the average daily trading volume of building materials for the entire month of May was 213,000 tons, and the average daily trading volume of building materials fell to 201,000 tons in the first half of June, and the trading volume may further decline in late June.

This week’s steel demand continued to be weak, coupled with the authorities’ crackdown on the price speculation of raw materials such as coal and iron ore, adding to the wait-and-see mentality of the market.

At the same time, as steel prices fluctuate and weaken and gradually approach the cost line, the profitability of steel mills continues to shrink, and steel output may decline in the later stage, which also has a willingness to suppress upstream raw material prices.

In the short term, there are many negative factors in the steel market, and steel prices may continue to be weak.

Post time: Jun-23-2021