INTERNATIONAL NEWS

▲ In April, the Markit manufacturing PMI and service industry PMI both hit record highs. The initial value of the Markit Manufacturing PMI in the United States in April was 60.6, which was estimated to be 61, and the previous value was 59.1. The initial value of the Markit service industry PMI in the United States in April was 63.1, and the estimated value was 61.5. The previous value was 60.4.

▲ China and the United States issued a joint statement on addressing the climate crisis: Committed to cooperating with each other and working with other countries to resolve the climate crisis, the two countries plan to take appropriate actions to maximize international investment and financing to support developing countries from high-carbon fossil energy to green and low-carbon And renewable energy transition.

▲ The Boao Forum for Asia’s “Asian Economic Prospects and Integration Process” report pointed out that, looking forward to 2021, Asian economies will experience recovery growth, with economic growth expected to reach more than 6.5%. The epidemic is still the main variable that directly affects Asian economic performance.

▲ The U.S.-Japan joint statement stated that U.S. President Biden and Japanese Prime Minister Yoshihide Suga launched the U.S.-Japan climate partnership; the U.S. and Japan pledged to take decisive climate actions by 2030 and achieve net zero greenhouse gas emissions by 2050 The goal.

▲ The Central Bank of Russia unexpectedly raised the key interest rate to 5%, compared to 4.5% previously. The Central Bank of Russia: The rapid recovery in demand and rising inflationary pressures require an early restoration of a neutral monetary policy. Taking into account the monetary policy stance, the annual inflation rate will return to the target level of the Central Bank of Russia in the middle of 2022, and will continue to stay close to 4%.

▲Thailand’s exports in March increased by 8.47% year-on-year, and are expected to fall by 1.50%. Thailand’s imports in March increased by 14.12% year-on-year, which is estimated to increase by 3.40%.

STEEL INFORMATION

▲ At present, the first shipment of 3,000 tons of recycled steel materials imported by Xiamen International Trade has completed customs clearance. This is the first shipment of imported recycled iron and steel raw materials to be signed and successfully cleared by Fujian enterprises since the implementation of the regulations on the free import of domestic recycled iron and steel raw materials this year.

▲ China Iron and Steel Association: In March 2021, key statistical iron and steel enterprises produced a total of 73,896,500 tons of crude steel,has gown year on year of 18.15%. the daily output of crude steel was 2,383,800 tons, were down month over month of 2.61% and has grown year on year of 18.15%.

▲ Ministry of Industry and Information Technology: The increase in commodity prices has an impact on the manufacturing industry, but the impact is generally manageable. The next step will be to actively take measures with relevant departments to promote the stabilization of raw material prices and prevent panic buying or hoarding in the market.

▲ Hebei Province: We will strictly control coal consumption in key industries such as steel and vigorously promote photovoltaic, wind power and hydrogen energy.

▲Asia billet prices continued their upward trend this week, reaching a new high in nearly 9 years, mainly due to strong demand from the Philippines. As of April 20, the mainstream billet resource price in Southeast Asia is around US$655/ton CFR.

▲ National Bureau of Statistics: The crude steel output in Hebei and Jiangsu exceeded 10 million tons in March, and the combined output accounted for 33% of the country’s total output. Among them, Hebei Province ranked first with a crude steel output of 2,057.7 thousand tons, followed by Jiangsu Province with 11.1864 million tons, and Shandong Province ranked third with 7,096,100 tons.

▲ On April 22, the “Steel Industry Low-Carbon Work Promotion Committee” was formally established.

OCEAN FREIGHT FOR CONTAINER CARGO ON INTERNATIONAL ROUTES

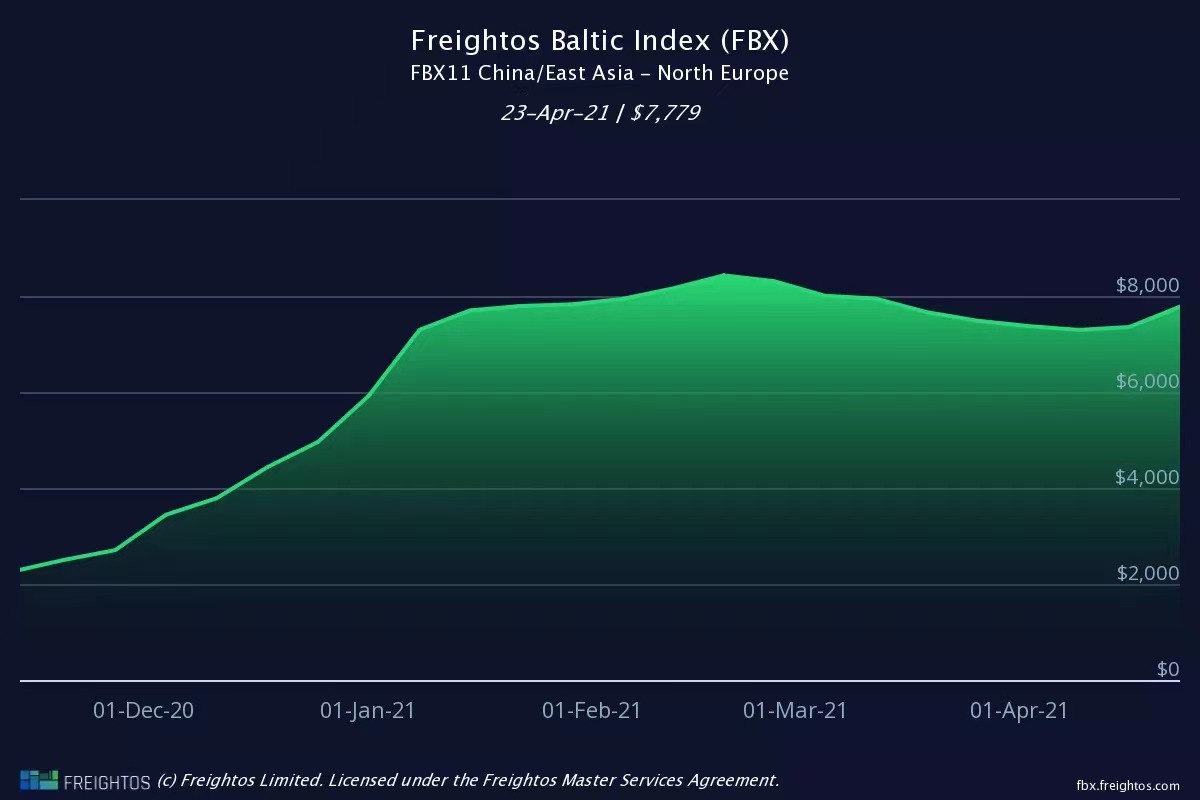

CHINA/EAST ASIA – NORTH EUROPE

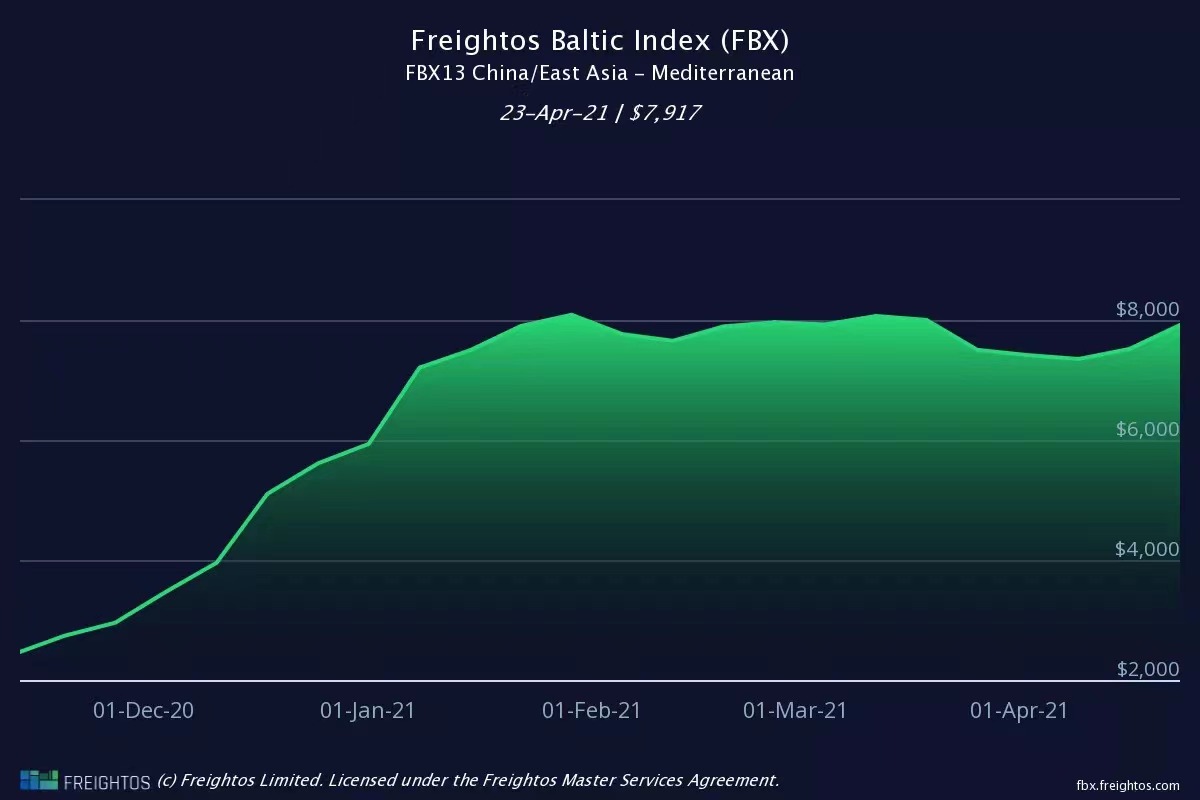

CHINA/EAST ASIA – MEDITERRANEAN

MARKET ANALYSIS

▲ BILLET:

Last week, the ex-factory price of billet basically remained stable. For the first four working days, the common carbon billet resources of steel mills in Changli area were reported at 4,940 CNY/Mt including tax, which increased by 10 CNY/Mt on Friday and 4950 CNY/Mt including tax. The internal fluctuation space is limited. In the early stage, due to the loss of profits of the billet rolling mills in Tangshan area, a few have already stopped production. On the 22nd of last week, the local rolling mills entered a state of suspension in accordance with government requirements. The demand for billets continued to be sluggish, and the total local warehouse inventory increased to 21.05 for four consecutive days. However, the price has not been affected by this, but the price has been reduced. Instead, it has risen slightly. The main supporting factor is the limited delivery volume of steel mills. In addition, there are more forward transactions of billets at the end of April. Near the end of the month, there is some demand for some orders. It appears that, in addition to the volatility and rise of the snails this week, the price of billet remains high in many aspects. It is expected that the price of billet will still fluctuate at a high level this week, with limited room for up and down fluctuations.

▲ IRON ORE:

The iron ore market price rose strongly last week. In terms of domestically-produced mines, there is still a divergence in regional price increases. From a regional perspective, the price increase of iron refined powder in North China and Northeast China was greater than that in Shandong. From the perspective of North China, the price of refined powder in Hebei led the increase in northern China such as Inner Mongolia and Shanxi. The pellet market in some parts of North China is gaining momentum due to extreme shortage of resources, while pellet prices in other regions are temporarily stable. From market understanding, enterprises in Tangshan area are still strictly implementing production restriction policy arrangements. At present, the shortage of domestically produced fine powder and pellet resources has caused market demand in some areas to exceed demand. Raw material mine selection manufacturer ,seller holding tight spot and a strong willing of supporting the price.

In terms of imported ore, supported by policies and high profit margins, iron ore spot market prices have soared. However, affected by news of production restrictions in many places, market prices have stabilized near the weekend. From the perspective of the market as a whole, the current domestic steel prices continue to rise, and the average profit per ton has risen by more than 1,000 yuan. The huge profits of steel prices support the purchase of raw materials. The average daily molten iron output both rebounded month-on-month and year-on-year, and the output hit a recent high. As the weekend market news about enterprises in Wu’an, Jiangsu and other regions discussing emission reduction and production restrictions, the market sentiment is cautious or there is a risk of callback. Therefore, considering the above influence conditions, it is expected that the iron ore spot market will fluctuate strongly this week.

▲ COKE:

The first round of the domestic coke market’s rise has landed, and the second round of rise will begin near the weekend. From the perspective of supply, environmental protection in Shanxi has been tightened. Some coking companies in Changzhi and Jinzhong have limited production by 20%-50%. The four 4.3-meter coke ovens planned to be withdrawn at the end of June have gradually begun to shut down, involving a production capacity of 1.42 million tons. Traders have picked up a large number of goods and some steel mills have begun to replenish the inventory of coke enterprises. At present, the inventory in the coke enterprises is mostly at a low level. The coke enterprises said that some varieties of coke are tight and will not accept new customers for the time being.

From the demand side, the profit of steel mills is fair. Some steel mills with unlimited production requirements have increased production, which drives the demand for coke procurement, and some steel mills with low inventories have begun to replenish their warehouses. Near the weekend, there are no signs of relaxation of environmental protection restrictions in Hebei. However, some steel plants still maintain a relatively high consumption of coke. The coke inventory in steel plants has now been consumed below a reasonable level. The purchase demand for coke has gradually rebounded. The coke inventory in a few steel plants is relatively stable for the time being.

Judging from the current situation, coke companies are currently shipping smoothly, and speculative demand in the downstream market is more active, driving the supply and demand of the coke market to improve, coupled with the tight supply of some high-quality resources, some coke companies have a mentality of reluctant to sell and wait for growth, and the delivery speed is slowing down. , It is expected that the domestic coke market may implement the second round of increase this week.

Post time: Apr-23-2021