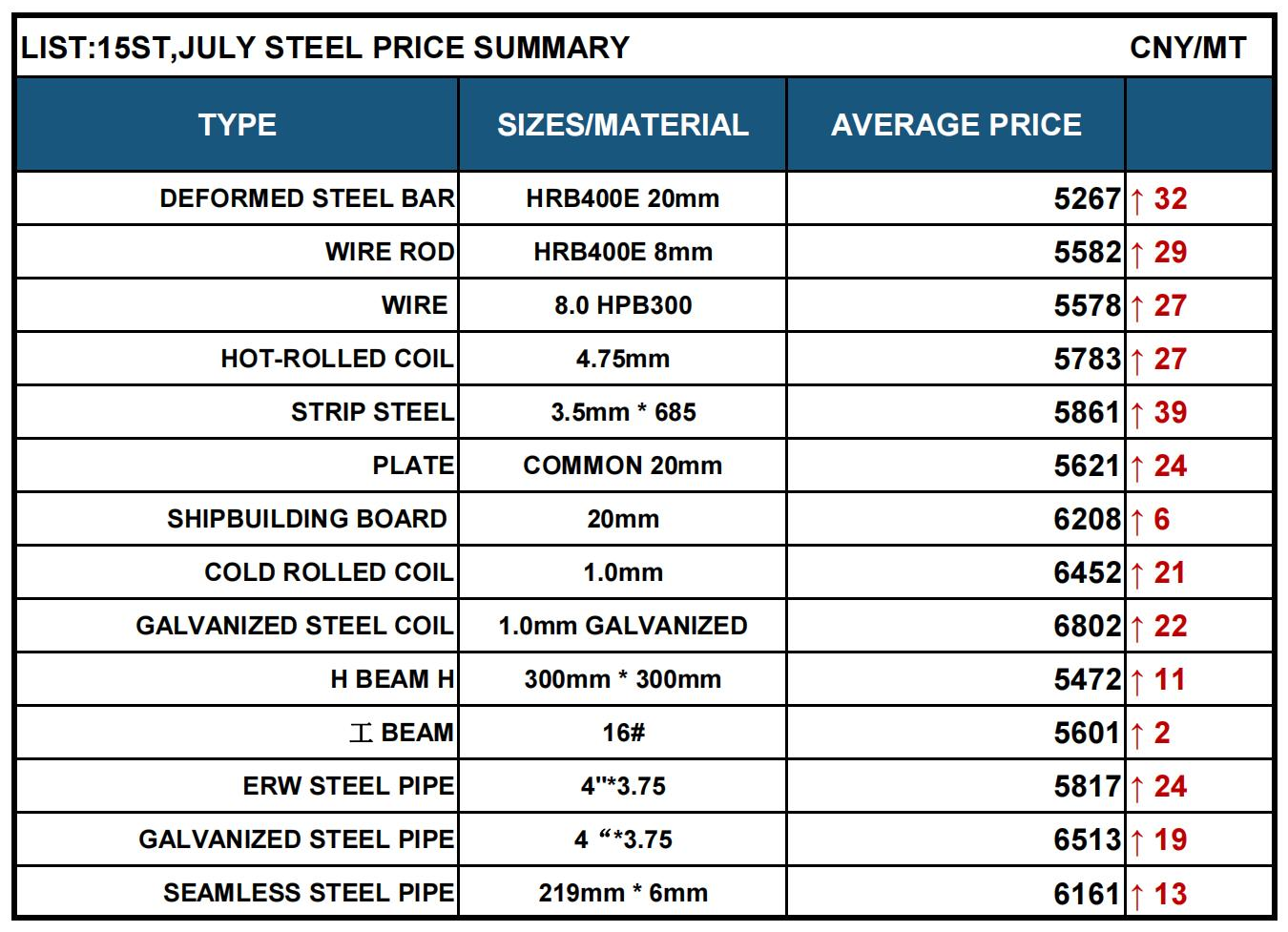

- On 15st.July , the domestic steel market generally rose, and the ex-factory price of Tangshan ordinary billet rose by 20 CNY, with a price of 5140 CNY/TON.

Affected by the Bank of China’s RRR cut and news of reducing crude steel production in many places, the market has strong bullish sentiment this week. Steel transaction volume has rebounded significantly, steel mill inventories have further declined, and manufacturers have actively pulled up. However, downstream terminal cost pressures have increased, and they are still purchasing on demand, and more speculative demand is active.

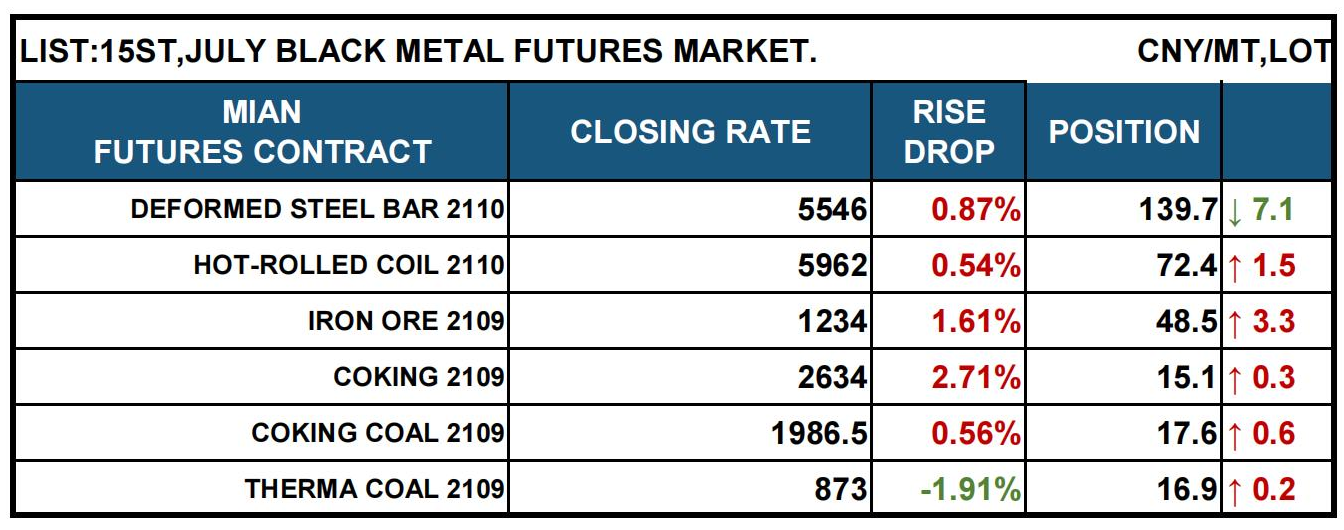

- On the 15th, the main force of future snails fluctuated strongly, and the closing price was 5546 yuan/ton, an increase of 0.87%.

- DIF and DEA continue to rise, and the RSI three-line indicator is located at 59-78, running close to the upper track of the Bollinger Bands.

Steel spot market news:

- Seamless steel pipes: On 15st July, the average price of seamless steel pipes with a length of 219mm*6mm and a length of 12M in 24 major cities across the country was 6,100 CNY/TON, an increase of 50 CNY/TON from the previous trading day.

- The spot market mentality is weak, the quotations of merchants fluctuate alternately, the trading atmosphere in the trading market is general, and the downstream demand is weak. However, due to the strong expectations of production restriction and production reduction, there is a certain degree of support for prices, and the current business mentality is on the sidelines.

- On the whole, it is expected that the market price of seamless steel pipes may fluctuate strongly on the 16th.

Raw material spot market information:

Coke:

- On July 15, the coke market was operating weakly, and the current round of increase did not fully land.

- On the demand side, the daily coke consumption of mainstream steel mills in Shandong has been greatly reduced, and some steel mills in Jiangsu have limited production of blast furnaces. Other steel mills have not been affected too much for the time being. the Lord.

- The situation of tight coke supply has recently changed, coke enterprises have increased their shipment pressure, and coke prices have fallen from high levels.

- In general, the current round of coke price cuts will be implemented, and there is still a risk of subsequent declines. The policy of reducing crude steel production and the policy of using steel to fix coke require continuous attention.

Scrap steel:

- On July 15, the average price of scrap steel in 45 major markets across the country was 3,252 CNY/TON, an increase of 7 CNY/TON from the previous trading day.

- The overall market for scrap steel resources is tight, and the delivery from steel mills is average, slightly lower than daily consumption. In-plant inventory continues to decline.

- In the short term, the strong price trend of finished products will increase scrap steel. However, under the situation of frequent production restrictions, scrap steel prices are expected to be difficult to rise sharply, or continue to grow steadily and strongly.

Steel market forecast:

- In terms of statistics: the latest statistics from the Bureau of Statistics show that in June, the country’s daily average crude steel output was 3,129,300 tons, a decrease of 2.5% from the previous month, and a significant decline for two c onsecutive months.

- On the supply side: this Friday, the output of large varieties of steel products was 10.683 million tons, an increase of 191,900 tons on a week-on-week basis.

- In terms of demand: the apparent consumption of large varieties of steel this Friday was 10.77228 million tons, an increase of 401,000 tons on a week-on-week basis.

- In terms of inventory: this week’s total steel inventory was 21.567 million tons, a week-on-week decrease of 89,000 tons. Among them, the steel mill inventory was 6,315,600 tons, a decrease of 243,100 tons on a week-on-week basis; the market steel inventory was 15,252,100 tons, an increase of 154,100 tons on a week-on-week basis.

- The short-term steel price is expected to fluctuate at a high level.

Post time: Jul-16-2021