■ ABSTRACT:The Ministry of Finance website reported on December 15 that in order to fully, accurately and fully implement the new development concept, support the construction of a new development pattern, and continue to promote high-quality development, with the approval of the State Council, the Tariff Commission of the State Council issued a notice that some commodities will be adjusted in 2022. Import and export duties.

TARIFF ADJUSTMENT PLAN FOR 2022:

1. Import tariff rate

In accordance with the “Regulations of the People’s Republic of China on Import and Export Tariffs”, the 2022 revision of the “Commodity Name and Coding System”, multilateral and bilateral economic and trade agreements, and my country’s industrial development, the following tax rates will be adjusted:

(1) The most-favored-nation tax rate.

■ According to the transition of the tax regulations and the adjustment of tax items, the most-favored-nation tax rate and ordinary tax rate shall be adjusted accordingly (see Attached Tables 1 and 8).

■ Effective July 1, 2022, the most-favored-nation tax rate for information technology products listed in the schedule of the “Amendment to the Tariff Concession Schedule of the People’s Republic of China’s Accession to the World Trade Organization” will be reduced in the seventh step (see Schedule 2).

■ Implementation of provisional import tariff rates for 954 commodities (excluding tariff quota commodities); starting from July 1, 2022, the provisional import tariff rates for products covered by seven information technology agreements will be cancelled (see Attached Table 3).

■ The most-favored-nation tax rate is applicable to imported goods originating in the Republic of Seychelles and the Democratic Republic of Sao Tome and Principe.

(2) Tariff quota tax rate.

■ Continue to implement tariff quota management on eight categories of commodities, including wheat, corn, paddy and rice, sugar, wool, wool tops, cotton, and chemical fertilizers, with the tax rate unchanged. Among them, the quota tax rate for urea, compound fertilizer, and ammonium hydrogen phosphate fertilizer will continue to implement the temporary import tax rate, and the tax rate will remain unchanged. Continue to implement sliding tax on a certain amount of additional imported cotton, and the tax rate will remain unchanged (see Attached Table 4).

(3) Conventional tax rate.

■ According to the free trade agreements and preferential trade arrangements that my country has signed and entered into force with relevant countries or regions, treaty tax rates are applied to some imported goods originating in 28 countries or regions under 17 agreements: First, China and New Zealand , Peru, Costa Rica, Switzerland, Iceland, South Korea, Australia, Pakistan, Georgia, and Mauritius Free Trade Agreements further reduce tariffs; China-Switzerland Free Trade Agreement will expand products from certain IT agreements starting from July 1, 2022 in accordance with relevant regulations Reduce the treaty tax rate. Second, the free trade agreements between China and ASEAN, Chile, and Singapore, as well as the “Closer Economic and Trade Relations Arrangement (CEPA)” and “Cross-Strait Economic Cooperation Framework Agreement” (ECFA) between the Mainland and Hong Kong and Macau have completed tax reductions. Continue Implement the treaty tax rate. Third, the Asia-Pacific Trade Agreement will continue to be implemented, and the treaty tax rate will be reduced for some products expanded under the information technology agreement from July 1, 2022 (see Appendix 5).

■ According to the “Regional Comprehensive Economic Partnership Agreement” (RCEP), the agreement is implemented for some imported goods originating in Japan, New Zealand, Australia, Brunei, Cambodia, Laos, Singapore, Thailand, Vietnam and other 9 contracting parties that have entered into force The tax rate for the first year (see Attached Table 5); the implementation time for the subsequent effective parties will be announced separately by the Tariff Commission of the State Council. In accordance with the provisions of the “tariff difference” and other provisions of the agreement, according to the RCEP country of origin of the imported goods, my country’s corresponding agreed tariff rates for other contracting parties that have entered into force under the RCEP shall be applied. At the same time, importers are allowed to apply for the application of my country’s highest treaty tax rate for other contracting parties that have entered into force under the RCEP; or, if the importer can provide relevant certificates, allow the importer to apply for the application of my country’s other effective contracting parties related to the production of the goods. Party’s highest treaty tax rate.

■ According to the Free Trade Agreement between the Government of the People’s Republic of China and the Government of the Royal Kingdom of Cambodia, the first-year tax rate of the agreement is applied to some imported goods originating in Cambodia (see attached table 5).

■ When the most-favored-nation tax rate is lower than or equal to the agreed tax rate, if the agreement has provisions, it shall be implemented in accordance with the relevant agreement; if the agreement has no provisions, the two shall apply from the lower.

(4) Preferential tax rate.

■ Preferential tax rates will be implemented for 44 least developed countries including the Republic of Angola that have established diplomatic relations with China and completed the exchange of notes (see attached table 6).

2. Export tariff rate

■ Continue to implement export tariffs on 106 commodities including ferrochrome, and increase the export tariffs on two commodities including phosphorus and blister copper other than yellow phosphorus (see attached table 7). STEEL PRODUCTS.

3. Tax rules and tax items

■ My country’s import and export tariff items will be adjusted simultaneously with the 2022 revision of the “Commodity Names and Coding Harmonized System”, and some tariff items and notes will be adjusted according to domestic needs (see attached tables 1, 8-9). After the adjustment, the number of tax items in 2022 will be 8,930.

4. Implementation time

■ The above plan, unless otherwise specified, will be implemented from January 1, 2022.

Link to the notice and schedule:

http://gss.mof.gov.cn/gzdt/zhengcefabu/202112/t20211215_3775137.htm

Source:Ministry of Finance of the People’s Republic of China.

Editor:Ali

MORE PRODUCT INFOMATION:

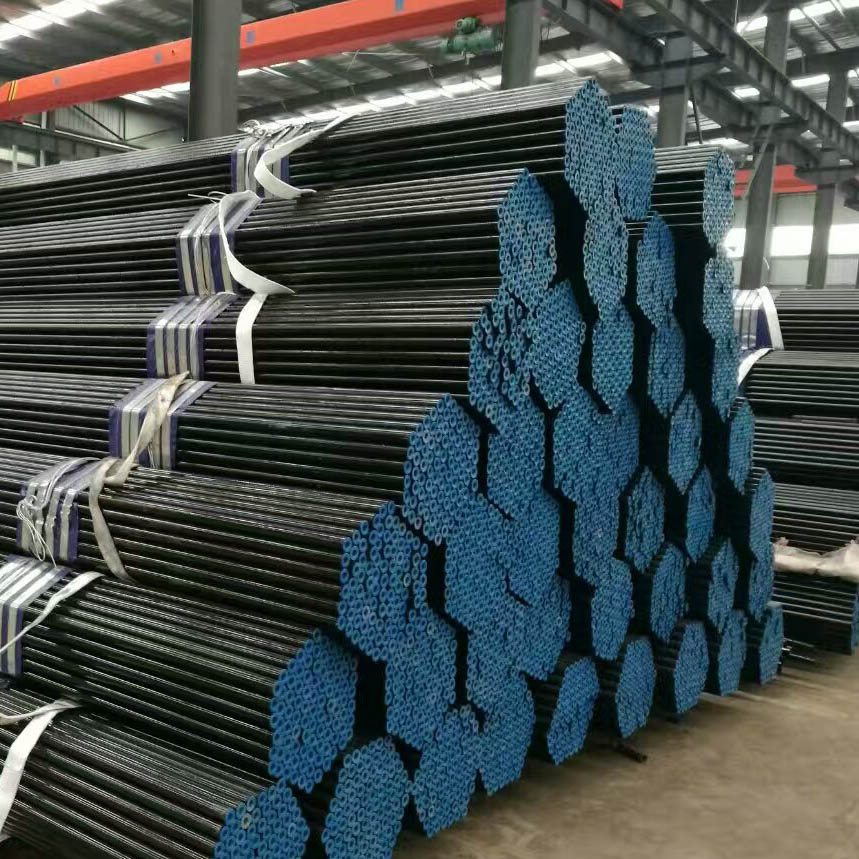

PRECISION SEAMLESS STEEL PIPE HYDRAULIC CYLINDER SEAMLESS STEEL TUBE API 5LGr.B Black Painted Line Pipe

Post time: Dec-16-2021