The price of steel products in the domestic market fluctuated upward in March, and it is difficult to continue to rise in the later period, so small fluctuations should be the main trend.

In March, the domestic market demand was strong, and the price of steel products fluctuated upward, and the increase was greater than the previous month. Since the beginning of April, steel prices have risen first and then fell, generally continuing to fluctuate upward.

1. China’s domestic steel price index rose month-on-month.

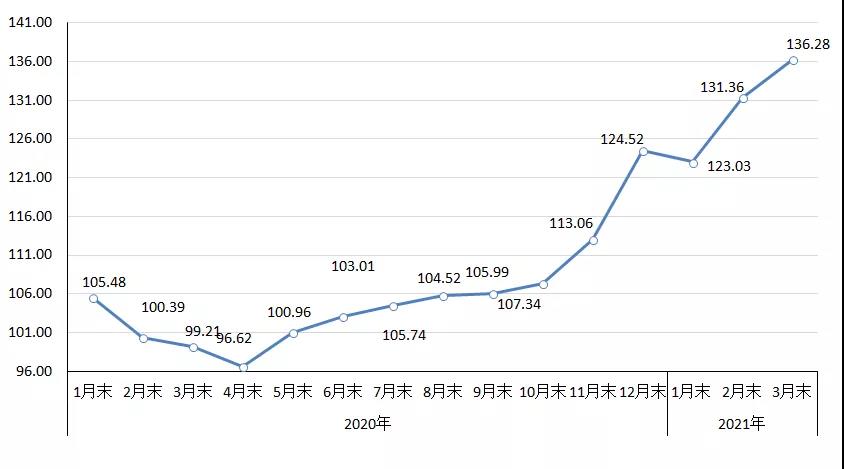

According to the monitoring of the Iron and Steel Association, at the end of March, the China Steel Price Index (CSPI) was 136.28 points, an increase of 4.92 points from the end of February, an increase of 3.75%, and a year-on-year increase of 37.07 points, an increase of 37.37%. (See below)

China Steel Price Index (CSPI) chart

- The prices of major steel products have risen.

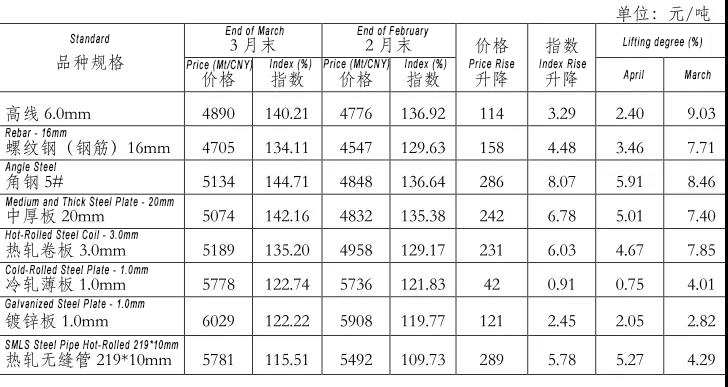

At the end of March, the prices of all the eight major steel varieties monitored by the Iron and Steel Association increased. Among them, the prices of angle steel, medium and heavy plates, hot-rolled coils and hot-rolled seamless pipes have increased significantly, rising by 286 yuan/ton, 242 yuan/ton, 231 yuan/ton and 289 yuan/ton respectively from the previous month; The price increase of rebar, cold rolled sheet and galvanized sheet was relatively small, rising by 114 yuan/ton, 158 yuan/ton, 42 yuan/ton and 121 yuan/ton respectively from the previous month. (See the table below)

Table of changes in prices and indices of major steel products

2.Analysis of the changing factors of steel prices in the domestic market.

In March, the domestic market entered the peak season of steel consumption, downstream steel demand was strong, international market prices rose, exports also maintained growth, market expectations increased, and steel prices continued to rise.

- (1) The main steel industry is stable and improving, and the demand for steel continues to grow.

According to the National Bureau of Statistics, the gross domestic product (GDP) in the first quarter increased by 18.3% year-on-year, 0.6% from the fourth quarter of 2020, and 10.3% from the first quarter of 2019; the national fixed asset investment (excluding rural households) increased year-on-year 25.6%. Among them, infrastructure investment increased by 29.7% year-on-year, real estate development investment increased by 25.6% year-on-year, and the newly started area of houses increased by 28.2%. In March, the value added of industrial enterprises above designated size increased by 14.1% year-on-year. Among them, the general equipment manufacturing industry increased by 20.2%, the special equipment manufacturing industry increased by 17.9%, the automobile manufacturing industry increased by 40.4%, the railway, ship, aerospace and other transportation equipment manufacturing industry increased by 9.8%, and the electrical machinery and equipment manufacturing industry increased by 24.1%. The computer, communications and other electronic equipment manufacturing industry grew by 12.2%. On the whole, the national economy started well in the first quarter, and the downstream steel industry has strong demand.

- (2) Steel production has maintained a high level, and steel exports have increased significantly.

According to the statistics of the Iron and Steel Association, in March, the national output of pig iron, crude steel and steel (excluding repetitive materials) was 74.75 million tons, 94.02 million tons and 11.87 million tons, respectively, up by 8.9%, 19.1% and 20.9% year-on-year; The daily output of steel was 3.0329 million tons, an average increase of 2.3% over the first two months. According to customs statistics, in March, the country’s cumulative export of steel products was 7.54 million tons, a year-on-year increase of 16.4%; imported steel products were 1.32 million tons, a year-on-year increase of 16.0%; net steel exports were 6.22 million tons, a year-on-year increase of 16.5%. Steel production in the domestic market maintained a high level, steel exports continued to rebound, and the supply and demand situation in the steel market remained stable.

- (3) The prices of imported mines and coal coke have been corrected, and the overall prices are still high.

According to the statistics of the Iron and Steel Association, at the end of March, the price of domestic iron ore concentrates increased by 25 yuan/ton, the price of imported ore (CIOPI) fell by 10.15 US dollars/ton, and the prices of coking coal and metallurgical coke fell by 45 yuan/ton and 559 yuan/ton respectively. Ton, the price of scrap steel increased by 38 yuan/ton month-on-month. Judging from the year-on-year situation, domestic iron ore concentrates and imported ore rose by 55.81% and 93.22%, coking coal and metallurgical coke prices rose by 7.97% and 26.20%, and scrap steel prices rose by 32.36%. The prices of raw materials and fuels are consolidating at a high level, which will continue to support steel prices.

3.The price of steel products in the international market continued to rise, and the month-on-month increase expanded.

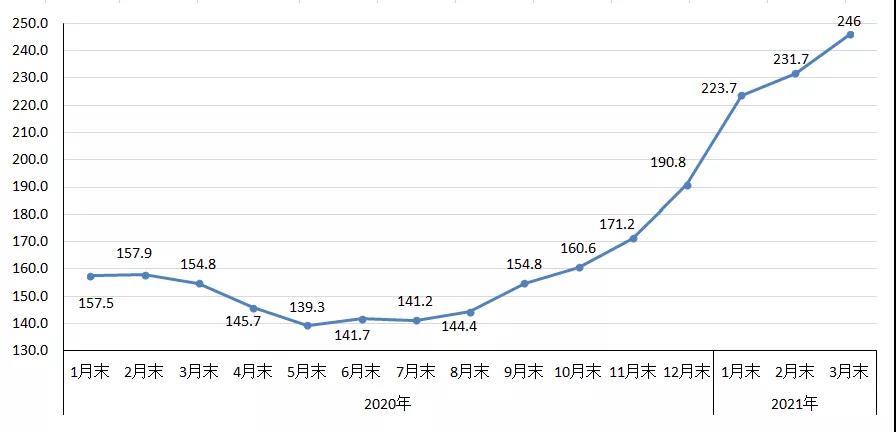

In March, the international steel price index (CRU) was 246.0 points, an increase of 14.3 points or 6.2% month-on-month, an increase of 2.6 percentage points over the previous month; an increase of 91.2 points or 58.9% over the same period last year. (See the figure and table below)

International Steel Price Index (CRU) chart

4.Analysis of the price trend of the later steel market.

At present, the steel market is in a peak demand season. Due to factors such as environmental protection restrictions, production reduction expectations and export growth, steel prices in the later market are expected to remain stable. However, due to the large increase in the early period and the faster growth rate, the difficulty in transmitting to the downstream industry has increased, and it is difficult for the price to continue to rise in the later period, and small fluctuations should be the main reason.

- (1) The global economic growth is expected to improve, and the demand for steel continues to grow

Looking at the international situation, the world economic situation continues to improve. The International Monetary Fund (IMF) released the “World Economic Outlook Report” on April 6, predicting that the global economy will grow by 6.0% in 2021, up 0.5% from the January forecast; the World Steel Association issued a short-term forecast on April 15 In 2021, global steel demand will reach 1.874 billion tons, an increase of 5.8%. Among them, China grew by 3.0%, excluding countries and regions other than China, which grew by 9.3%. Looking at the domestic situation, my country is in the first year of the “14th Five-Year Plan”. As the domestic economy continues to recover steadily, the protection of investment project factors has been continuously strengthened, and the growth trend of stable investment recovery in the later period will continue to be consolidated. “There is still a lot of investment space in the transformation of traditional industries and the upgrading of emerging industries, which has a strong stimulating effect on the demand for manufacturing and steel.

- (2) Steel production remains at a relatively high level, and it is difficult for steel prices to rise sharply.

According to statistics from the Iron and Steel Association, in the first ten days of April, the daily crude steel production (same caliber) of key steel companies increased by 2.88% month-on-month, and it is estimated that the country’s crude steel output increased by 1.14% month-on-month. From the perspective of the supply-side situation, the “looking back” of iron and steel capacity reduction, the reduction of crude steel output, and environmental supervision are about to start, and it is difficult for the crude steel output to increase significantly in the later period. From the demand side, due to the rapid and large increase in steel prices since March, the downstream steel industries such as shipbuilding and home appliances cannot withstand the continuous high consolidation of steel prices, and the subsequent steel prices cannot continue to rise sharply.

- (3) Steel inventories continued to decline, and market pressure was reduced in the later period.

Affected by the rapid growth of demand in the domestic market, steel inventories have continued to decline. In early April, from the perspective of social stocks, the social stocks of the five major steel products in 20 cities were 15.22 million tons, which was down for three consecutive days. The cumulative decline was 2.55 million tons from the high point during the year, a decrease of 14.35%; a decrease of 2.81 million tons year-on-year. 15.59%. From the perspective of steel enterprise inventory, the iron and steel association’s key statistics of steel enterprise steel inventory is 15.5 million tons, an increase from the first half of the month, but compared with the high point in the same year, it fell by 2.39 million tons, a decrease of 13.35%; a year-on-year decrease of 2.45 million tons, a decrease It was 13.67%. Enterprise inventories and social inventories continued to decline, and the market pressure was further reduced in the later period.

5. The main issues that need to be paid attention to in the later market:

- First, the level of steel production is relatively high, and the balance of supply and demand is facing challenges. From January to March this year, the national crude steel output reached 271 million tons, a year-on-year increase of 15.6%, maintaining a relatively high level of production. The market supply and demand balance is facing challenges, and there is a large gap between the country’s annual output reduction requirements. Iron and steel enterprises should rationally arrange production pace, adjust product structure according to changes in market demand, and promote the balance of market supply and demand.

- Second, the high fluctuating prices of raw materials and fuels have increased the pressure on steel companies to reduce costs and increase efficiency. According to the monitoring of the Iron and Steel Association, on April 16, the CIOPI imported iron ore price was US$176.39/ton, a year-on-year increase of 110.34%, which was much higher than the increase in steel prices. The prices of raw materials such as iron ore, scrap steel, and coal coke continue to be high, which will increase the pressure on iron and steel companies to reduce costs and increase efficiency in the later stages.

- Third, the global economy is facing uncertain factors and exports are facing greater difficulties. Last Friday, the World Health Organization held a press conference stating that in the past two months, the weekly number of new cases of new crown cases worldwide has nearly doubled, and it is approaching the highest infection rate since the outbreak, which will cause a drag on the recovery of the global economy and demand. In addition, the domestic steel export tax rebate policy may be adjusted, and steel exports are facing greater difficulties.

Post time: Apr-22-2021